Dire Straits

China’s Push to Secure Its

Energy Interests in the Middle East

China is expanding its footprint in the Middle East to meet its vast energy needs. Near the Strait of Hormuz, the world’s most important chokepoint for transporting oil, Chinese companies have invested heavily in ports and energy infrastructure. The People’s Liberation Army (PLA) has also set its sights on the critical waterway.

As Chinese leaders look to further secure their interests in the region, they may draw from the playbook they used in Djibouti for leveraging commercial inroads to further military and intelligence activities.

China established its first overseas military facility in Djibouti in 2017.

The base is strategically situated just 110 kilometers (km) from the Bab al-Mandab Strait, a narrow waterway that—along with the Suez Canal—is a critical artery for transporting goods between Europe and Asia.

Before opening the base, Chinese firms poured billions of dollars into Djibouti to develop ports, build railways and airports, and establish a sprawling free-trade zone.

China’s approach in Djibouti is characteristic of what some Chinese scholars have labeled “first civilian, then military” (先民后军). Under this strategy, China invested in infrastructure for commercial purposes and later “converted” them to support the military. These projects eased the process by earning Beijing considerable political clout along the way.

Chinese military scholars describe the Djibouti base as a “strategic strongpoint” (战略支点) that helps secure critical trade routes.

As its interests in the region grow, China may look to establish another strategic strongpoint to further safeguard its trade along the Strait of Hormuz. Nearly one-third of all seaborne crude oil transits the critical waterway each year, and the U.S. Department of Defense lists the strait as a “known focus area” for Chinese military planners.

In the United Arab Emirates (UAE), China constructed several facilities at Khalifa Port, as well as an oil pipeline that stretches to the Port of Fujairah; in Oman, it is investing billions at the emerging Duqm Port.

While these investments offer near-term economic benefits to China and its partners, they may also lay the groundwork for the PLA to further project power near the Strait of Hormuz.

In 2021, China imported a staggering $128 billion worth of crude oil from countries along the Persian Gulf and the Strait of Hormuz—three times more than the United States and European Union combined.

Analysts in China have warned that upwards of 45 percent of the country’s oil imports sail through the strait, and they have called for boosting cooperation with regional partners to ensure safe passage of energy resources.

Chinese state-owned enterprises (SOEs) have spent big on trying to solve the Hormuz challenge.

From 2008 to 2012, the China Petroleum Engineering and Construction Company constructed the Habshan–Fujairah oil pipeline, which bypasses Hormuz by stretching some 380 km from the interior of the UAE to the Port of Fujairah.

The pipeline faced several construction delays but was ultimately completed at a cost of $3.3 billion. Another key state-owned firm, Sinopec, holds a 50 percent stake in a major terminal at Fujairah that operates 36 tanks for storing oil, gasoline, and other chemicals.

Just over 160 km to the west, China has paved deep economic inroads at Khalifa Port. A subsidiary of shipping giant COSCO inked a $738 million agreement in 2016 to construct a container terminal there. The venture includes a 35-year deal wherein China has exclusive design, construction, and management rights over the terminal.

More recently, in October 2022, China Harbour Engineering Company (CHEC) won a bid to build a new 700,000 square meter container yard and 36 supporting buildings at the port. CHEC is a subsidiary of China Communications Construction Company, one of the 24 entities that the Trump administration sanctioned for supporting China’s construction of artificial islands in the South China Sea.

Several Chinese companies are also involved in constructing the UAE’s national Etihad rail network, which will connect several ports with major trade and industrial hubs throughout the Arabian Peninsula.

China’s activities in the UAE extend beyond investments. In January 2020, a three-vessel PLA Navy task force stopped for five days at Khalifa Port and visited a nearby UAE military base. The port call was one of many in the area that has supported Chinese anti-piracy escort missions in the Gulf of Aden, which have been ongoing since 2008. These port calls advance China’s military diplomacy and enable replenishing of Chinese vessels as they operate in surrounding seas.

There is some evidence that China desires a more permanent military presence in the UAE. The Department of Defense lists the UAE among the countries where the PLA has considered establishing an overseas military facility. In 2021, Khalifa Port was at the center of a controversy when U.S. intelligence agencies accused China of secretly beginning to construct a military facility at the port. Reports suggest that Washington warned Emirati officials about China’s activities and China appeared to stop work on the facility in question.

A new facility would go a long way toward expanding China’s naval presence, but the PLA would not need a sprawling base at Khalifa Port (or elsewhere) to project power into the Strait of Hormuz. Even a light footprint could assist the PLA in sustaining expeditionary operations. A limited logistics facility, for instance, could store prepositioned dual-use goods such as petroleum, basic maintenance equipment, food, and water.

In 2021, China imported a staggering $128 billion worth of crude oil from countries along the Persian Gulf and the Strait of Hormuz—three times more than the United States and European Union combined.

Analysts in China have warned that upwards of 45 percent of the country’s oil imports sail through the strait, and they have called for boosting cooperation with regional partners to ensure safe passage of energy resources.

Chinese state-owned enterprises (SOEs) have spent big on trying to solve the Hormuz challenge.

From 2008 to 2012, the China Petroleum Engineering and Construction Company constructed the Habshan–Fujairah oil pipeline, which bypasses Hormuz by stretching some 380 km from the interior of the UAE to the Port of Fujairah.

The pipeline faced several construction delays but was ultimately completed at a cost of $3.3 billion. Another key state-owned firm, Sinopec, holds a 50 percent stake in a major terminal at Fujairah that operates 36 tanks for storing oil, gasoline, and other chemicals.

Just over 160 km to the west, China has paved deep economic inroads at Khalifa Port. A subsidiary of shipping giant COSCO inked a $738 million agreement in 2016 to construct a container terminal there. The venture includes a 35-year deal wherein China has exclusive design, construction, and management rights over the terminal.

More recently, in October 2022, China Harbour Engineering Company (CHEC) won a bid to build a new 700,000 square meter container yard and 36 supporting buildings at the port. CHEC is a subsidiary of China Communications Construction Company, one of the 24 entities that the Trump administration sanctioned for supporting China’s construction of artificial islands in the South China Sea.

Several Chinese companies are also involved in constructing the UAE’s national Etihad rail network, which will connect several ports with major trade and industrial hubs throughout the Arabian Peninsula.

China’s activities in the UAE extend beyond investments. In January 2020, a three-vessel PLA Navy task force stopped for five days at Khalifa Port and visited a nearby UAE military base. The port call was one of many in the area that has supported Chinese anti-piracy escort missions in the Gulf of Aden, which have been ongoing since 2008. These port calls advance China’s military diplomacy and enable replenishing of Chinese vessels as they operate in surrounding seas.

There is some evidence that China desires a more permanent military presence in the UAE. The Department of Defense lists the UAE among the countries where the PLA has considered establishing an overseas military facility.

In 2021, Khalifa Port was at the center of a controversy when U.S. intelligence agencies accused China of secretly beginning to construct a military facility at the port. Reports suggest that Washington warned Emirati officials about China’s activities and China appeared to stop work on the facility in question.

A new facility would go a long way toward expanding China’s naval presence, but the PLA would not need a sprawling base at Khalifa Port (or elsewhere) to project power into the Strait of Hormuz. Even a light footprint could assist the PLA in sustaining expeditionary operations. A limited logistics facility, for instance, could store prepositioned dual-use goods such as petroleum, basic maintenance equipment, food, and water.

Even without a formal military facility, the PLA already has options in how it can support operations in the region. Sensors placed into Chinese-owned port terminals can assist in collecting signals intelligence on other militaries. PLA personnel have also been known to embed within Chinese firms, giving the PLA an additional platform for gaining intelligence.

Importantly, China’s 2017 National Defense Transportation Law requires Chinese companies engaged in international shipping to “provide assistance in personnel rest and resupply for ships, aircraft, and automobiles participating in international rescues, maritime escorts, and military operations in defending national interests.”

With this legal basis established, the PLA Navy could leverage Chinese companies already operating at Khalifa Port—for example, by using Chinese commercial vessels for at-sea replenishment of naval assets.

China is making similar strategic investments at Duqm, on the southern coast of neighboring Oman. In May 2016, Oman Wanfang, a consortium of private Chinese companies, signed a 50-year lease with the Special Economic Zone Authority at Duqm to co-develop the China-Oman (Duqm) Industrial Park.

The consortium has committed to investing some $10.7 billion for the development of a nearly 13 square km industrial “city” within the Duqm Special Economic Zone.

The park is still in its infancy, but its ambitions are immense. It aims to encompass several projects, including an oil refinery, a multibillion-dollar methanol plant, a solar power equipment production facility, an oil and gas equipment production site, and other industries. There are also plans for tourism and housing zones.

China’s investments at Duqm are commercial in nature, but they are reminiscent of the “Port-Park-City Model” (or Shekou Model, 蛇口模式), which China has utilized to gain significant political and economic leverage within host countries. This model entails Chinese companies investing heavily to develop industrial parks linked to ports and coupling this with the creation of new cities.

China has used the Port-Park-City Model to significant effect in other countries, including Pakistan, Sri Lanka, Belarus, and Togo.

Most pointedly, in 2017 the vice-chairman of state-owned China Merchants Bank named Djibouti as a key success story of the Port-Park City Model.

China’s investments in Duqm could aid China in establishing a fixed military facility there. Duqm is already a focal point for several militaries. The United Kingdom established its own Joint Logistics Support Base at Duqm in 2017, and the U.S. and Indian navies have also secured permission to call at port there.

At first glance, the presence of U.S. and other militaries at Duqm might seem to complicate any Chinese efforts to further its own military presence, but countries in the region have shown a notable impartiality toward disparate security partners. China’s base in Djibouti is accompanied by U.S., French, Italian, Japanese, and Saudi military facilities also in the country.

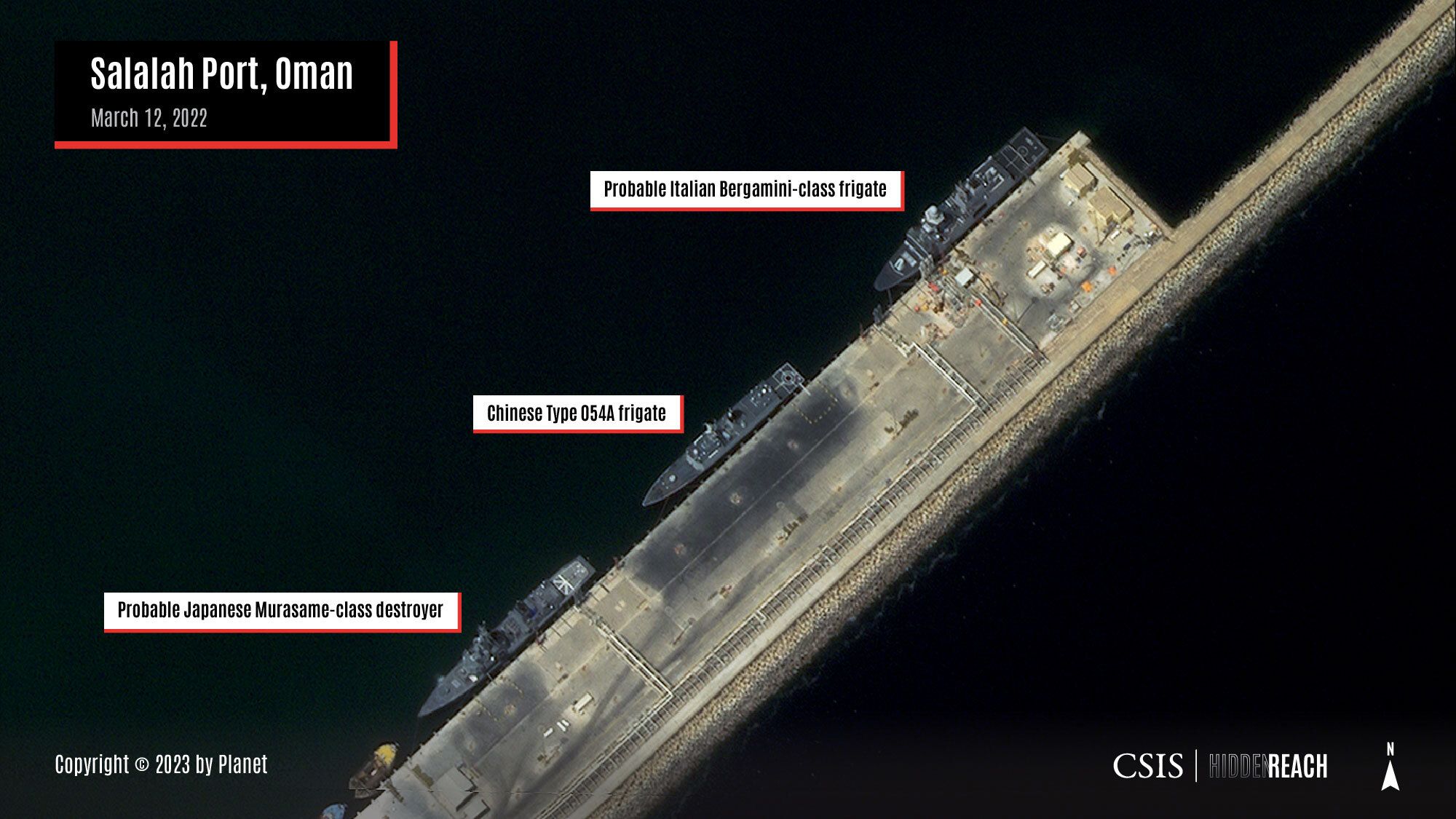

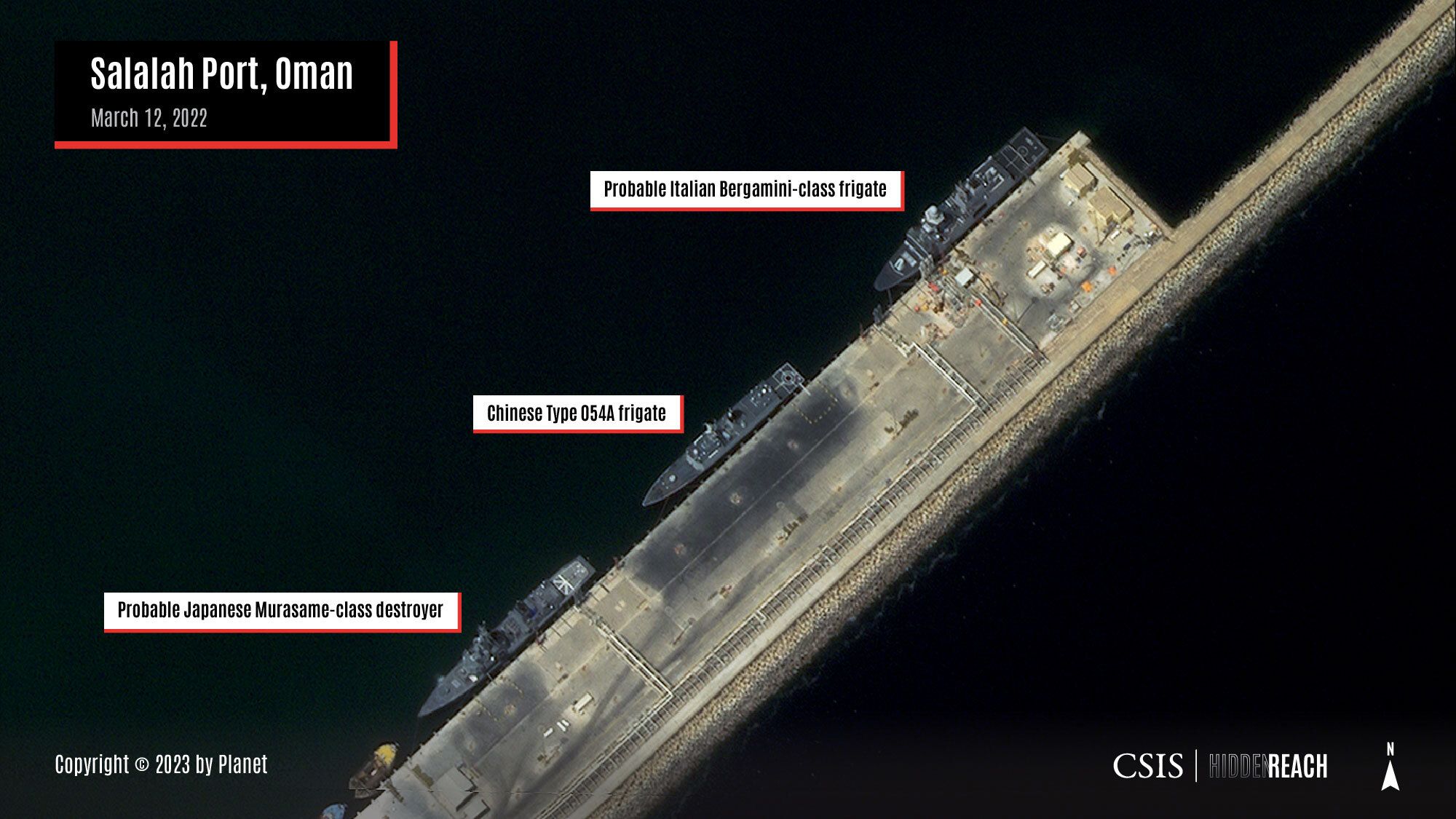

Oman’s Port of Salalah, which sits about 480 km southwest of Duqm, has been the most frequently visited port for Chinese naval vessels engaged in antipiracy operations, yet Oman concurrently agreed in 2019 to expand the U.S. Navy’s access to the Port of Salalah (and Duqm).

The UAE has shown a similar ambivalence. U.S. and French forces are based at Al Dhafra Air Base, just 60 km from Khalifa Port, where PLA Navy vessels have called at port.

This impartiality may reflect recognition among regional powers that they must navigate an international system increasingly dominated by U.S.-China competition. As Washington and Beijing bid for influence abroad, countries like the UAE and Oman benefit from maintaining strong ties with both economic superpowers.

China is making similar strategic investments at Duqm, on the southern coast of neighboring Oman. In May 2016, Oman Wanfang, a consortium of private Chinese companies, signed a 50-year lease with the Special Economic Zone Authority at Duqm to co-develop the China-Oman (Duqm) Industrial Park.

The consortium has committed to investing some $10.7 billion for the development of a nearly 13 square km industrial “city” within the Duqm Special Economic Zone.

The park is still in its infancy, but its ambitions are immense. It aims to encompass several projects, including an oil refinery, a multibillion-dollar methanol plant, a solar power equipment production facility, an oil and gas equipment production site, and other industries. There are also plans for tourism and housing zones.

China’s investments at Duqm are commercial in nature, but they are reminiscent of the “Port-Park-City Model” (or Shekou Model, 蛇口模式), which China has utilized to gain significant political and economic leverage within host countries. This model entails Chinese companies investing heavily to develop industrial parks linked to ports and coupling this with the creation of new cities.

China has used the Port-Park-City Model to significant effect in other countries, including Pakistan, Sri Lanka, Belarus, and Togo.

Most pointedly, in 2017 the vice-chairman of state-owned China Merchants Bank named Djibouti as a key success story of the Port-Park City Model.

China’s investments in Duqm could aid China in establishing a fixed military facility there. Duqm is already a focal point for several militaries. The United Kingdom established its own Joint Logistics Support Base at Duqm in 2017, and the U.S. and Indian navies have also secured permission to call at port there.

At first glance, the presence of U.S. and other militaries at Duqm might seem to complicate any Chinese efforts to further its own military presence, but countries in the region have shown a notable impartiality toward disparate security partners. China’s base in Djibouti is accompanied by U.S., French, Italian, Japanese, and Saudi military facilities also in the country.

Oman’s Port of Salalah, which sits about 480 km southwest of Duqm, has been the most frequently visited port for Chinese naval vessels engaged in antipiracy operations, yet Oman concurrently agreed in 2019 to expand the U.S. Navy’s access to the Port of Salalah (and Duqm).

The UAE has shown a similar ambivalence. U.S. and French forces are based at Al Dhafra Air Base, just 60 km from Khalifa Port, where PLA Navy vessels have called at port.

This impartiality may reflect recognition among regional powers that they must navigate an international system increasingly dominated by U.S.-China competition. As Washington and Beijing bid for influence abroad, countries like the UAE and Oman benefit from maintaining strong ties with both economic superpowers.

It remains to be seen if or when China will develop a formal military facility on the Arabian Peninsula, and it is worth noting that Chinese investments stretch well beyond the UAE and Oman to other regional actors.

Regardless, in the coming years, the PLA will be on the lookout for ways to bolster its position in the region. The country’s energy needs are only growing, which will keep Chinese leaders focused on securing critical trade flows.

Chinese leaders are also pouring billions of dollars into transforming the PLA into a “world-class” fighting force. This effort includes fielding a “blue water” navy that is capable of projecting military power far from its own shores. Navies operating thousands of kilometers from their home shores need access to overseas facilities.

In pursuing its growing ambitions, however, China must navigate an increasingly contentious political environment. The United States and likeminded nations are pushing back against China’s growing military assertiveness, which may incline Beijing to secure its goals slowly and incrementally.

Officials in Washington are increasingly wary of the challenges posed by China in the region. In 2019, Lieutenant General Giovanni K. Tuck, then-director of logistics for the Joint Chiefs of Staff, told the House Committee on Transportation and Infrastructure that China’s expanding influence in the region may “expose data” and impinge on “our ability to use ports [and] access ships.” He added that China’s influence could “strain or change our relationships with partners and allies.”

There are indicators that China’s growing presence has already weighed on Washington’s partnerships in the region. U.S. concerns about China’s potential construction of a military base at Khalifa Port, and the UAE’s selection of Huawei as its 5G partner of choice in 2019, contributed to the U.S. freezing the planned sale of F-35 stealth fighters and other equipment to the UAE during the final year of the Trump administration.

There are also concerns that Chinese Huawei equipment sold to the UAE could be used to passively track and spy on F-35s. The sale has still not yet gone through.

These setbacks could hamper Washington’s broader foreign policy ambitions. While recent administrations have signaled a desire to pivot the United States away from the Middle East, the UAE and Oman remain important regional partners for the United States.

The UAE hosts thousands of U.S. military personnel, and over the last decade (2011–2021) it was the fourth-largest U.S. arms purchaser behind South Korea and ahead of Japan. Oman, meanwhile, played a role in negotiating U.S.-Iran talks that led to the Joint Comprehensive Plan of Action nuclear agreement in July 2015.

Importantly, there are potential scenarios in which the PLA Navy could play a constructive role in the region. Chinese efforts to tamp down a future crisis in the Strait of Hormuz could (at least in theory) bring stability to global energy markets. How actors in the Middle East would react to such a scenario, however, remains to be seen.

As Beijing’s interests in the region continue to grow, Washington needs to keep a watchful eye on Chinese activities. A new PLA facility could very well be on the horizon. Policymakers should plan for that possibility and prepare to navigate the shifting seas of regional power dynamics.

Written by Matthew P. Funaiole, Brian Hart, and Lily McElwee.

Satellite imagery analysis by Joseph S. Bermudez Jr. and Jennifer Jun.

Research support by Jaehyun Han and Henry Li.

Special thanks to Jon B. Alterman, Bonny Lin, Will Todman, and Sarah Grace.

Production and maps by Michael Kohler.

Design by William Taylor.

Copyediting support by Katherine Stark.

Satellite Imagery: Copyright © 2023 by Maxar Technologies, Copyright © 2023 by Planet

Photo & Video: CCTV via Getty Images, Mandel Ngan/AFP via Getty Images, U.S. Navy

Maps: © Mapbox, © OpenStreetMap