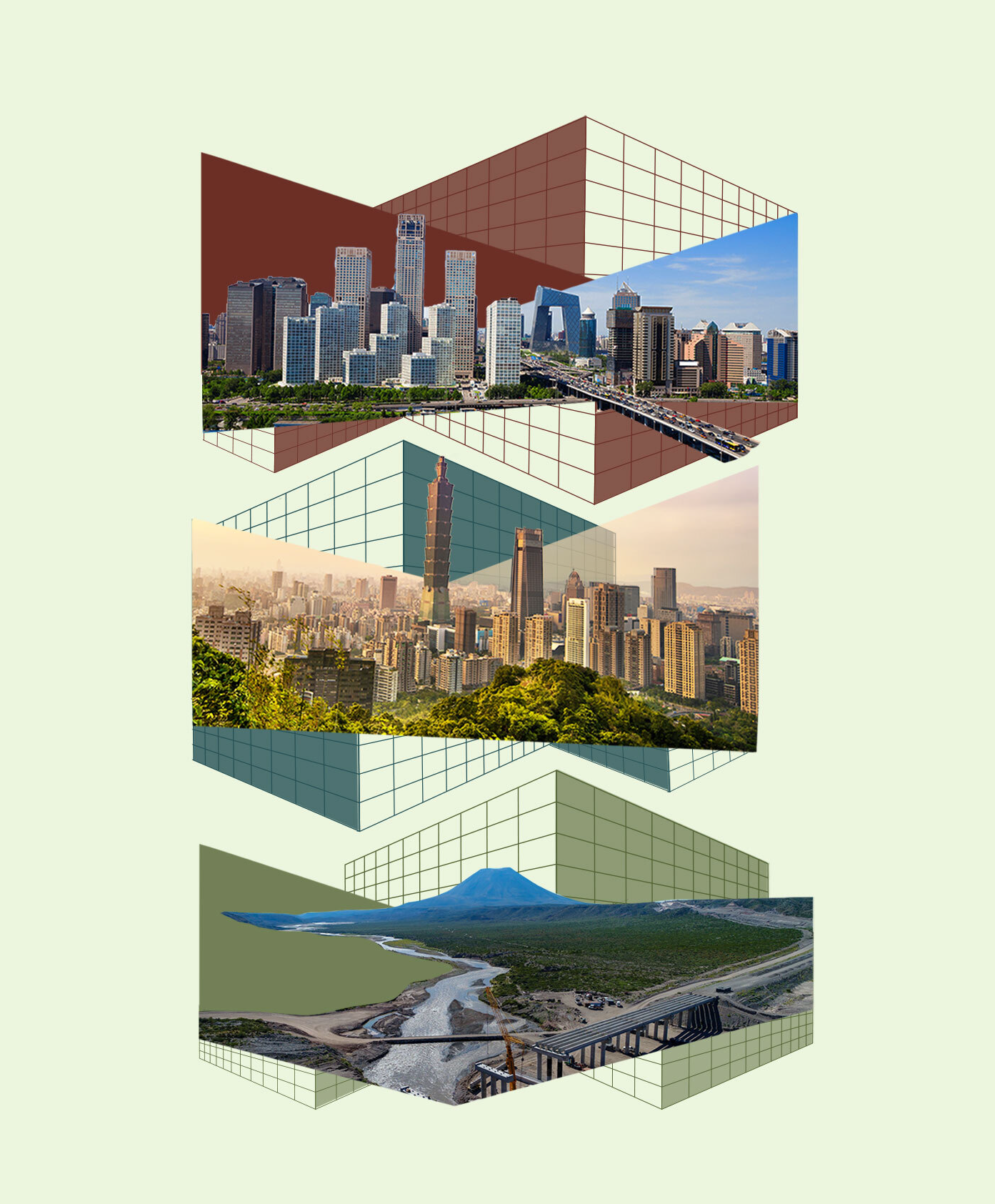

Divergent Approaches to Development

Taiwan vs. China in Latin America & the Caribbean

By Ryan C. Berg & Rubi Bledsoe | August 31, 2023

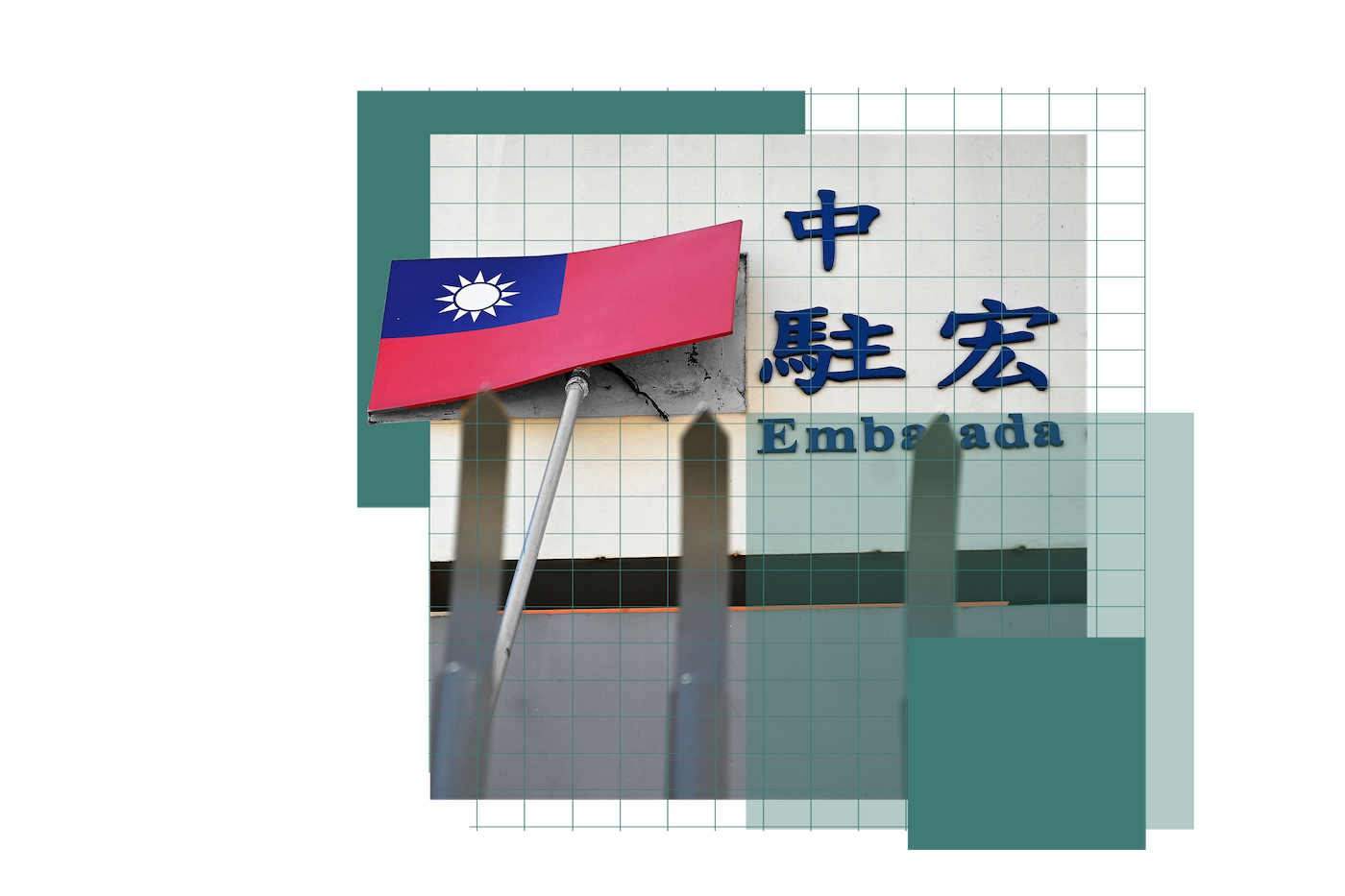

In March 2023, Honduras formally established diplomatic relations with China, ending an eight-decade alliance with Taiwan.

This reduced the number of Taiwan’s diplomatic allies to just 13 countries.

While over half of Taiwan’s diplomatic allies remain in Latin America and the Caribbean (LAC), the People's Republic of China (PRC) is making strides toward its goal of isolating Taiwan in the region, with Honduras being the most recent example.

China’s efforts to poach Taiwan’s allies in LAC are set to continue past Honduras.

China’s campaign to weaken Taiwan’s legitimacy is based on economic engagement, mainly through its Belt and Road Initiative (BRI). In return, the region has provided China with substantial access to natural resources and a foothold in the United States’ shared neighborhood.

While Chinese investment in the region can be beneficial in the short term, too often, LAC countries have been left with incomplete projects, environmental catastrophes, and corruption.

In the area of development, Taiwan presents a stark contrast to the Chinese model of engagement. Through its diplomatic partnerships, the small island seeks to invest in human capital and digitalization, ameliorate poverty through microfinance and agricultural sufficiency, and accelerate social and economic development of host countries.

Latin America

and the Caribbean

At a Crossroads

LAC countries have pressing economic and political factors to consider when deciding to pursue development opportunities with either China or Taiwan.

The region has suffered from chronic infrastructure problems for decades.

A recent study placed LAC’s roads, railroads, and ports in the region at the same level as sub-Saharan Africa. The latter, for instance, exceeds LAC by 8,000 kilometers of rail line, and nearly half of LAC’s rail line is concentrated in countries like Brazil.

Airports in the region have also lacked the necessary investment in expansion projects to keep pace with increased air traffic, and the digital divide in Latin America’s urban and rural areas has only widened.

To stay on pace with economic growth, over $120–$150 billion in infrastructure investment is needed annually to fill the region’s infrastructure gap.

Foreign development assistance and foreign direct investment have been the main tools deployed to meet these critical needs.

In the past 20 years, China has emerged as a primary funder for Latin America and the Caribbean.

China’s investment exceeds the lending of the World Bank, the Inter-American Development Bank, and the CAF Development Bank of Latin America combined. It also surpassed investment from the U.S. Development Finance Corporation and its predecessors.

Key Initial PRC Pledges to LAC Countries

Costa Rica

Date of Diplomatic Reversal: June 6, 2007

- $83 million stadium

- $300 million in government bonds

- $1 billion venture to expand oil refineries

- Multiple highways

Panama

Date of Diplomatic Reversal: June 12, 2017

- $4.1–$5.5 billion railroad connecting Panama City to its border with Costa Rica

- $14.8 million grant for scholarships for Panamanian students

- $1 billion deepwater port and logistics complex on Panama’s Margarita Island near the Colón Port

El Salvador

Date of Diplomatic Reversal: August 21, 2018

- $500 million in development projects, including a sports stadium

- $40 million national library in San Salvador

- A new tourist pier in La Libertad

- $85 million to improve water treatment facilities in La Libertad and Ilopango

- $200 million to support Bukele’s “Surf City” project

Dominican Republic

Date of Diplomatic Reversal: May 1, 2018

- $600 million loan to strengthen the country’s electric grid

- $300 million loan for a biomass and gas-fueled power plant

- $200 million loan for low-income housing

- Revitalization of Manzanillo Port, the closest port to the United States

Nicaragua

Date of Diplomatic Reversal: December 9, 2021

- $60 million for the construction of housing developments

- Donation of police equipment to the National Police

- MOUs establishing visa waivers and “commercial cooperation”

Honduras

Date of Diplomatic Reversal: March 25, 2023

- Twenty-two MOUs, ranging from market access for Honduran products to the initial stages of a free trade agreement

Due to the magnitude of Chinese investment in the region, LAC countries like Honduras face a difficult dilemma.

They must choose between two options:

1. Sign opaque infrastructure deals with China that can exacerbate corruption and result in unreliable and sometimes shoddy projects.

2. Forgo billions in foreign aid, trade, and investments by continuing their diplomatic relations with Taiwan, which offers more stable projects but has a fraction of the budget.

This difficult choice has been made by every country that switched.

China’s Development Model

A Belt and Road to the Americas

Initially, China’s engagement with countries in Latin America and the Caribbean involved foreign aid.

However, its economic engagement has gradually shifted toward foreign direct investment, which increases China’s return.

China’s investments in LAC have focused on energy, infrastructure, and extractive industries like mining.

As the region with the most remaining allies of Taiwan, LAC’s adoption of the One China principle has become an inseparable part of the PRC’s engagement with the region and is one of the bases for its strategy there.

China’s engagement with LAC serves three key interests.

1. Commodities

LAC countries have key commodities that China needs, which drove China’s initial foray into the region.

2. Competition

China can infringe on a region traditionally considered firmly in the U.S. sphere of influence.

3. Curtailment

By incentivizing LAC countries to change sides, China seeks to diplomatically isolate Taiwan on the global stage.

Between 2005 and 2021, China loaned around $140 billion to LAC.

However, these loans are directly tied to procurement of equipment and technical services imported from China. Chinese concessional loans consistently stipulate that at least 50 percent of the loan be tied to the purchase of Chinese goods.

Furthermore, China purposefully disburses loans to developing countries at adjustable interest rates, which are more volatile.

Weak currencies and an ever-shifting global interest rate make developing countries vulnerable to default on their loans.

This creates an avenue for China to extract concessions.

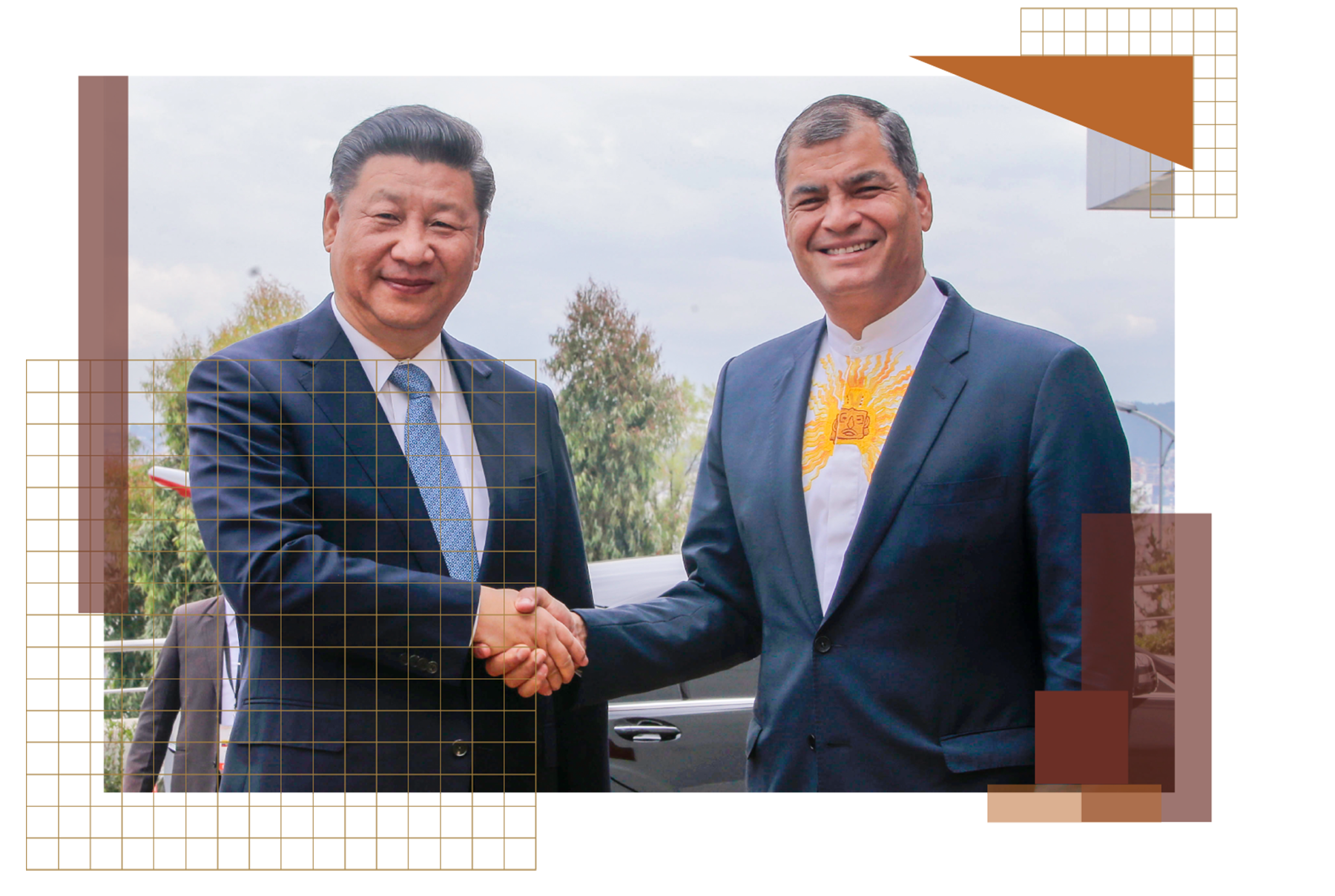

For example, in 2012, Beijing granted a $7.53 billion loan to Ecuador that added to the country’s mounting debt to China, then totaling around $25 billion. In return, China could claim as much as 90 percent of Ecuador’s oil shipments until 2020.

According to a report based on leaked Petrochina documents, the agreement states that if Ecuador defaults on its loans, Petrochina could appropriate assets from other companies extracting oil in Ecuador, which would include Ecuador’s national oil company.

With difficulty servicing this debt and fears of an impending debt default looming, Ecuador’s president, Guillermo Lasso, negotiated a debt restructuring agreement with China Development Bank and the Export-Import Bank of China.

Chinese development and investment projects present their own challenges. On average, China’s projects lack feasibility assessments and environmental and social impact evaluations, exacerbate levels of corruption, and disregard human and Indigenous rights.

After years of international criticism and backlash to Chinese projects in the region, China developed the China International Development Cooperation Agency (CIDCA). The new agency sought to address the lack of feasibility assessments, project evaluation, and project impact of Chinese development projects around the world.

However, five years after its creation, CIDCA has yet to publish any reports and claims its scope excludes BRI projects, casting doubt on whether accountability and transparency will become part of China’s model.

Taiwan’s Model

Accountability

and Human Capital

Taiwan’s development model is primarily powered by its goal of maintaining diplomatic recognition of countries across the world, but particularly in LAC, where more than half of its current diplomatic allies are located.

In contrast to China’s model, Taiwan develops assistance projects by following the Paris Declaration on Aid Effectiveness, adopted by the OECD, which focuses on the needs of recipient countries and on building their human capacity.

According to the International Cooperation and Development Fund (ICDF), Taiwan’s development agency, projects are “designed to match the norms and mechanisms of recipient countries rather than impose Taiwan’s own regulations or systems upon them.”

Taiwan’s scale of investment in LAC is significantly less than China’s, but Taiwan has historically dedicated between 30 and 50 percent of its development budget to LAC, and its total development assistance contribution per capita reaches $21.3, outweighing China’s $2.05.

Taiwan's engagement with LAC serves two key interests.

1. Diplomatic Survival

Ensuring diplomatic survival through meaningful and sustainable engagement.

2. International Relevance

Promoting foreign relations that strengthen Taiwan’s international status.

A recipient of foreign aid in the fifties and sixties, Taiwan’s own success story is the basis for its engagement in many parts of the developing world, including in LAC.

By the 1960s, Taiwan had already experienced impressive levels of economic growth and was well positioned to counter China’s attempts at diplomatic isolation through development.

The ICDF has a longer history than the CIDCA, evolving from its overseas missions first started in 1959.

Over the years, the ICDF has expanded to bring development projects to Taiwan’s diplomatic allies around the world.

A CSIS analysis of ICDF “after action” reports shows that Taiwan’s project design prioritizes the target country’s industry potential, local development needs, and UN Sustainable Development Goals.

Through its economic engagement in the region, Taiwan has sought to invest in human capital, ameliorate poverty rates, and increase climate resiliency among its diplomatic allies.

China's Projects

Big Ambitions

China’s BRI in the Americas has brought unprecedented financial investments to a region that for years has been underserved by other development banks.

Though the BRI was only officially extended to LAC in 2018, China’s earliest infrastructure projects in the region date back to 2005.

For the PRC, BRI is an important vehicle to expand its diplomatic presence across the world.

China has also used the BRI to offload excess capacity materials into international infrastructure and energy projects.

China’s projects in LAC countries have met varying levels of success.

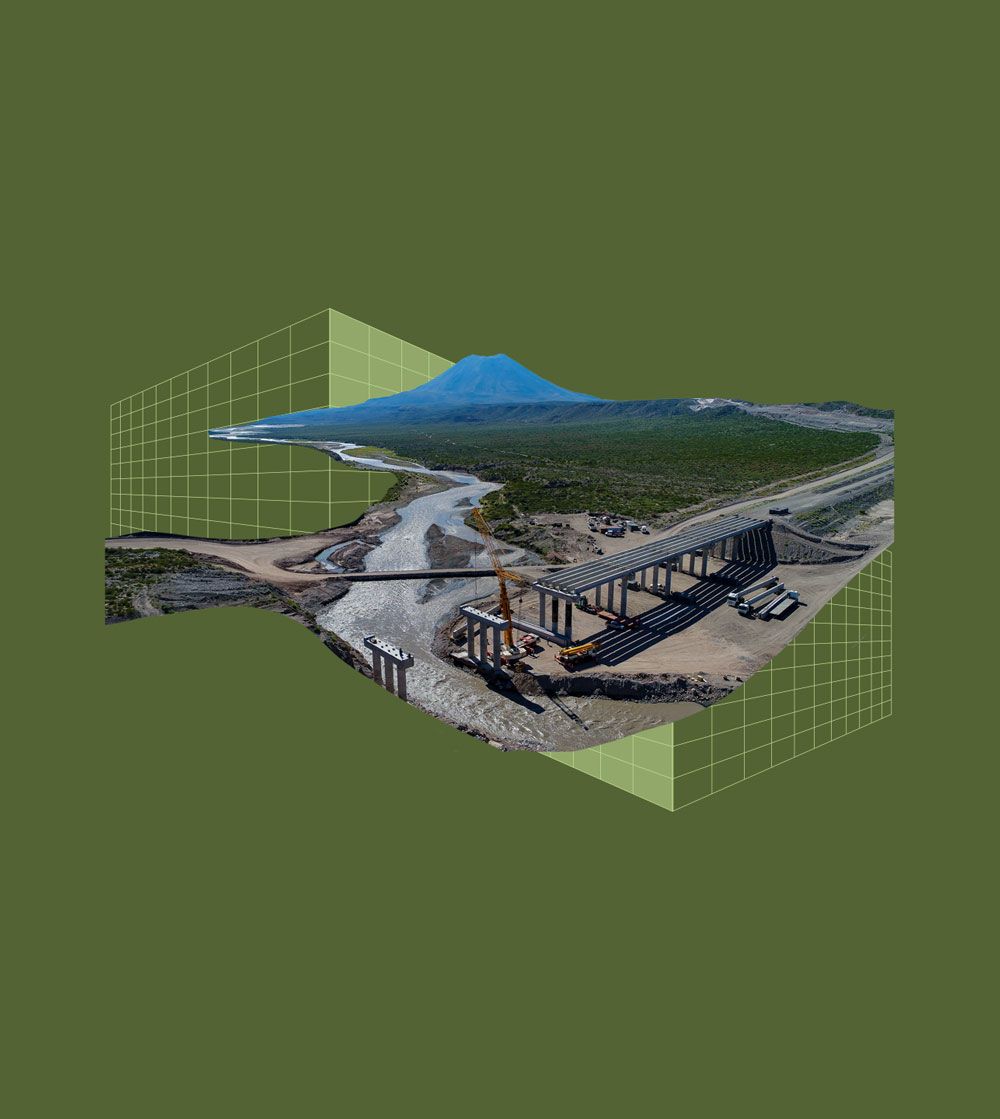

Ecuador

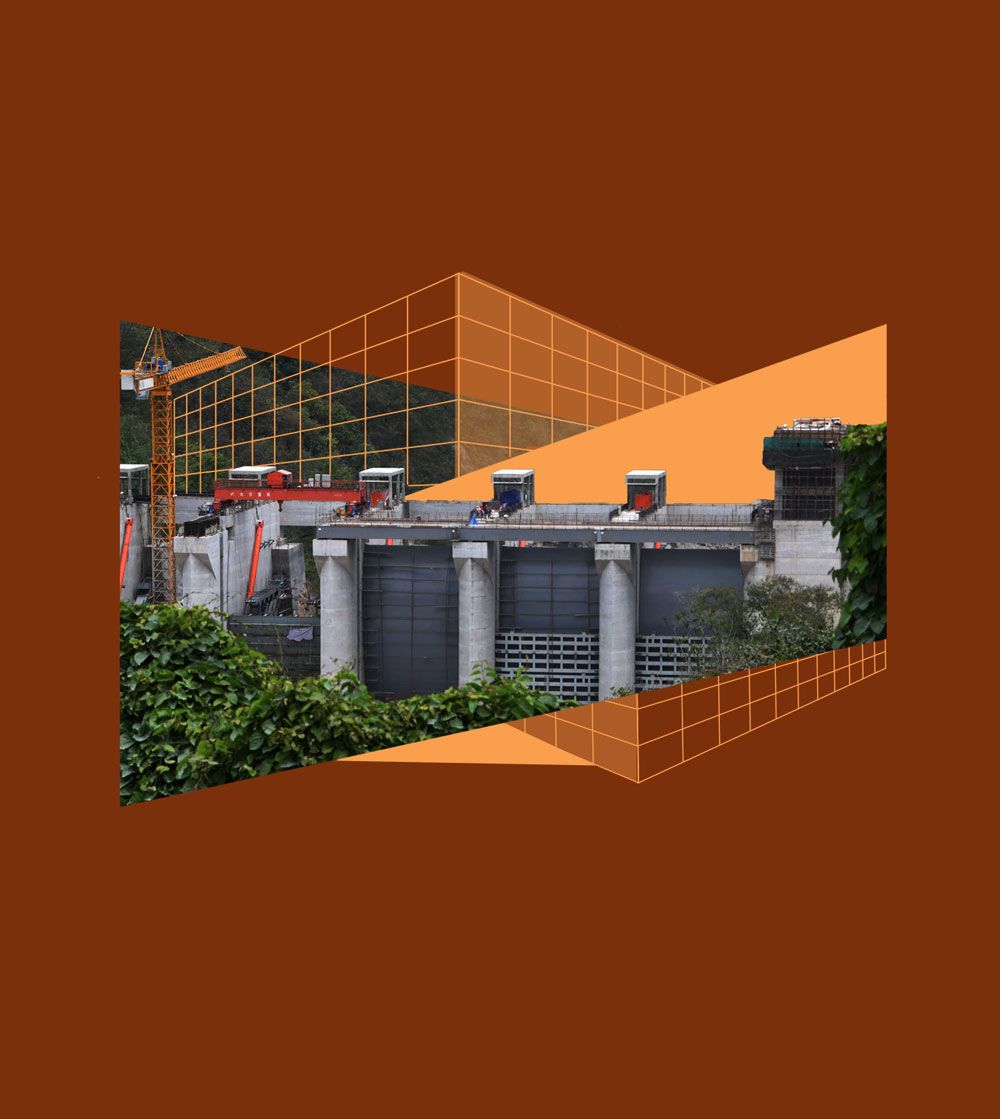

One of China’s first large infrastructure projects in the region was the Coca Codo Sinclair Dam in Ecuador, which took 10 years to complete.

In order to win the contract for the dam, China’s state-owned SinoHydro allegedly paid around $76 million in bribes to several dozen people, including former Ecuadoran president Lenín Moreno.

This allowed the state-owned entity not only to bypass the requirement that the project have a local partner but also to circumvent environmental compliance and project feasibility assessments.

Because of this, the construction of the dam may have led to the disappearance of the San Rafael waterfall and perilous erosion along the Coca River bank. The erosion contributed to major oil spills that contaminated the river’s water. Indigenous communities like the Quechua depend on the river for daily use.

This dam, and other hydroelectric projects, accounted for a majority of Quito’s $5.4 billion in outstanding debt to China, according to assessments.

Nicaragua

In 2013, Chinese company HK Nicaragua Canal Development Investment (HKND) began plans with the Nicaraguan government to build a 278-kilometer canal connecting Nicaragua’s Pacific coast and the Caribbean. A project that if completed would be three times the size of the Panama Canal, the Nicaragua canal’s estimated price was $40 billion, and it provided HKND with a 100-year concession to operate the canal. The project was approved by Nicaragua’s national assembly with no specifics on the canal route and no assessments of its financing or economic viability. After the canal route was published in 2014, the project faced fierce opposition from local communities that would be affected by the provision that allowed HKND the “right to possess, occupy, use or perform any activities upon all government owned and privately owned real property which may be reasonably necessary or desirable” for the canal. Between 2013 and 2018, there were over 90 protests organized across the country to oppose the project. In 2019, the U.S. Treasury Office of Foreign Assets Control (OFAC) deemed the canal project a “means to launder money and to acquire property along the planned canal route” and sanctioned three individuals, among them President Ortega’s son, Laureano Ortega Murillo, and Rosario Murillo, Ortega’s wife. As of July 2023, neither the Nicaraguan government nor HKND has issued any further comments about the status of the project.

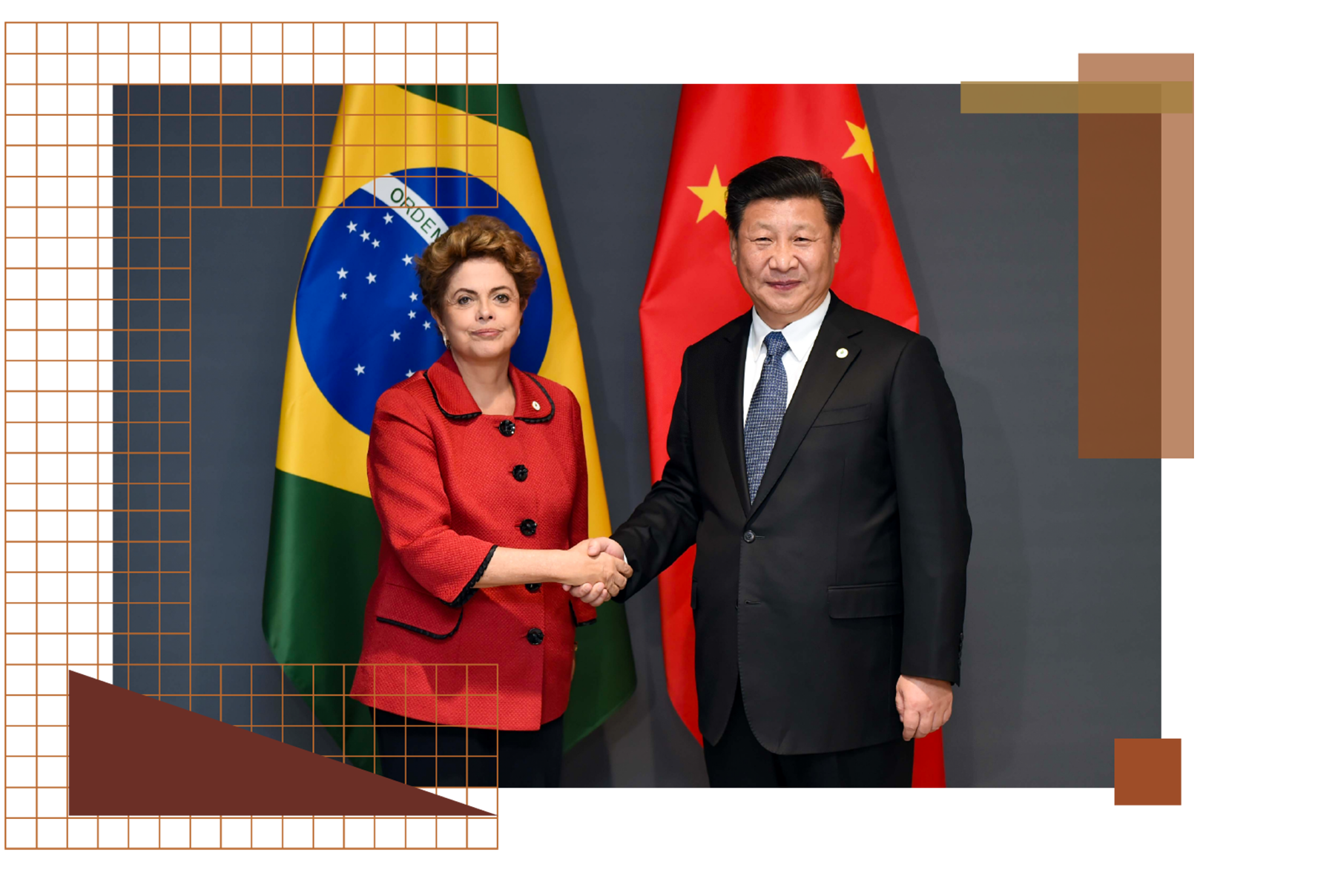

Brazil & Peru

The Brazil–Peru transcontinental railway was spearheaded by the governments of both countries as early as the mid-2000s. Due to low interests from local infrastructure companies, Brazil reached out to Beijing in 2014 and shortly after the three countries signed an agreement to begin the feasibility studies. China Railway Eryuan Engineering Group (CREEC) was entrusted with the project, which would receive a green light after the completion of feasibility studies. According to a report, the feasibility studies that CREEC presented to the Brazilian technical team offered “little or no social or environmental impact analysis, financial or economic modeling, budget, phasing for the project implementation, transhipment solutions for the different gauges used in Brazil and Peru, or definition of cargo hubs along the railway.” Despite several requests by the Brazilian team to supplement the initial assessment, CREEC maintained the study had been successfully completed. The decision decided to move ahead with the implementation of the project in spite of pushback is of concern. During the Dilma Rousseff administration, a 1,600-kilometer stretch of the project was granted permission to proceed, but her impeachment put the project in jeopardy and its current status is unknown. As of 2023, neither the Brazilian government nor CREEC has issued any further comments about the status of the project.

Venezuela

In 2006, China’s Railway Engineering Corporation (CREC) signed a contract with the government of Venezuela for $7.5 billion for the construction of the Tinaco–Anaco rail system that sought to connect the western part of the country to the eastern planes. The railway, covering a distance of 13,665 kilometers, had a projected completion date by 2012. An internal report by the president of Venezuela’s Railway Instituto, the partner entity of CREC, asserts that CREC presented the project plans to Venezuelan staff in Mandarin, did not adhere to Venezuelan construction regulations, and refused to hire Venezuelan companies. In 2021, the Venezuelan opposition claimed the Maduro regime diverted $30 million out of the $50 million disbursed for this project. In early 2015, CREC project directors left quietly, perhaps after assessing that neither Chávez nor Maduro would be able to ensure the loans were repaid. Ten years after the project's target end date, only 29 percent of the total length has been built, most of which has been cannibalized and vandalized.

Chile

While the list of aborted and partially completed Chinese projects in LAC is extensive, China’s more recent projects reflect a diversified portfolio that has shown promise in LAC.

In 2018, it sold Chinese electric buses to Chile, in order to improve Chile’s air quality and reduce the number of premature deaths due to respiratory issues.

In Santiago especially, these buses can make a significant impact through strong ridership in a city marked by chaos during rush hour.

China’s difficulties completing projects in the region

can be attributed to three key factors.

1. Feasibility

Domestically, China has codified comprehensive laws requiring impact appraisals on environmental, economic, and social impacts of programs and construction projects. However, China only provides guidelines for its companies operating internationally and shows little appetite for regulating Chinese firms’ environmental or risk assessments in BRI structures. This risks environmentally catastrophic or unfeasible projects.

2. Public Backlash

China has exacerbated levels of corruption and uses those systems in order to benefit economically and politically. Through elite capture, China is able to win infrastructure contracts proposed by the region’s political leaders. However, it fails to anticipate the level of public opposition from local communities against the projects.

3. Low ROI

China has abandoned projects after reassessing its projected economic gains. Projects with authoritarian regimes under heavy sanctions, like Venezuela, represent a smaller return on investment (ROI), and therefore are not a prosperous venture for China’s investing firms. Between 2013 and 2015, six of the top ten recipients of Chinese investment firms were classified in the highest category of default risk by the OECD.

The varied results of China’s infrastructure projects in the region should serve as a warning sign to regional governments about the short- and long-term impacts of these projects on the environment and the region’s democratic values and traditions.

Overall, LAC countries must consider the record of China’s infrastructure performance in the region, as well as the high levels of debt that may come as a result.

Furthermore, China’s investment in the LAC region has dwindled after the Covid-19 pandemic, shifting away from the massive infrastructure projects it was once focused on toward smaller scale projects.

Taiwan’s Projects

Strategic Efforts

Because Taiwan’s economy is a fraction of China’s, and thus its foreign aid budget more limited, it must be more judicious about how it allocates its resources in the region. Therefore, Taiwan’s projects in LAC differ from China’s in both type and scale.

In addition to agricultural projects, Taiwan’s strong presence in the ICT sector enables it to assist partner countries in building smart city capabilities with digital technology.

Paraguay

Taiwan’s strength in the ICT sector has also helped to modernize the approach to healthcare in the region. From 2016 to 2019, the ICDF piloted an e-health project in Paraguay to digitize patients’ records, establish a new inpatient management system, and introduce telemedicine into the government’s healthcare. At the conclusion of the pilot project, the Paraguayan Ministry of Health requested an extension and expansion of the program for three more years to include other hospitals across of the country. By the end of March 2023, the ICDF had implemented this digitization project in 145 health facilities and trained 14,080 healthcare staff on the new platform.

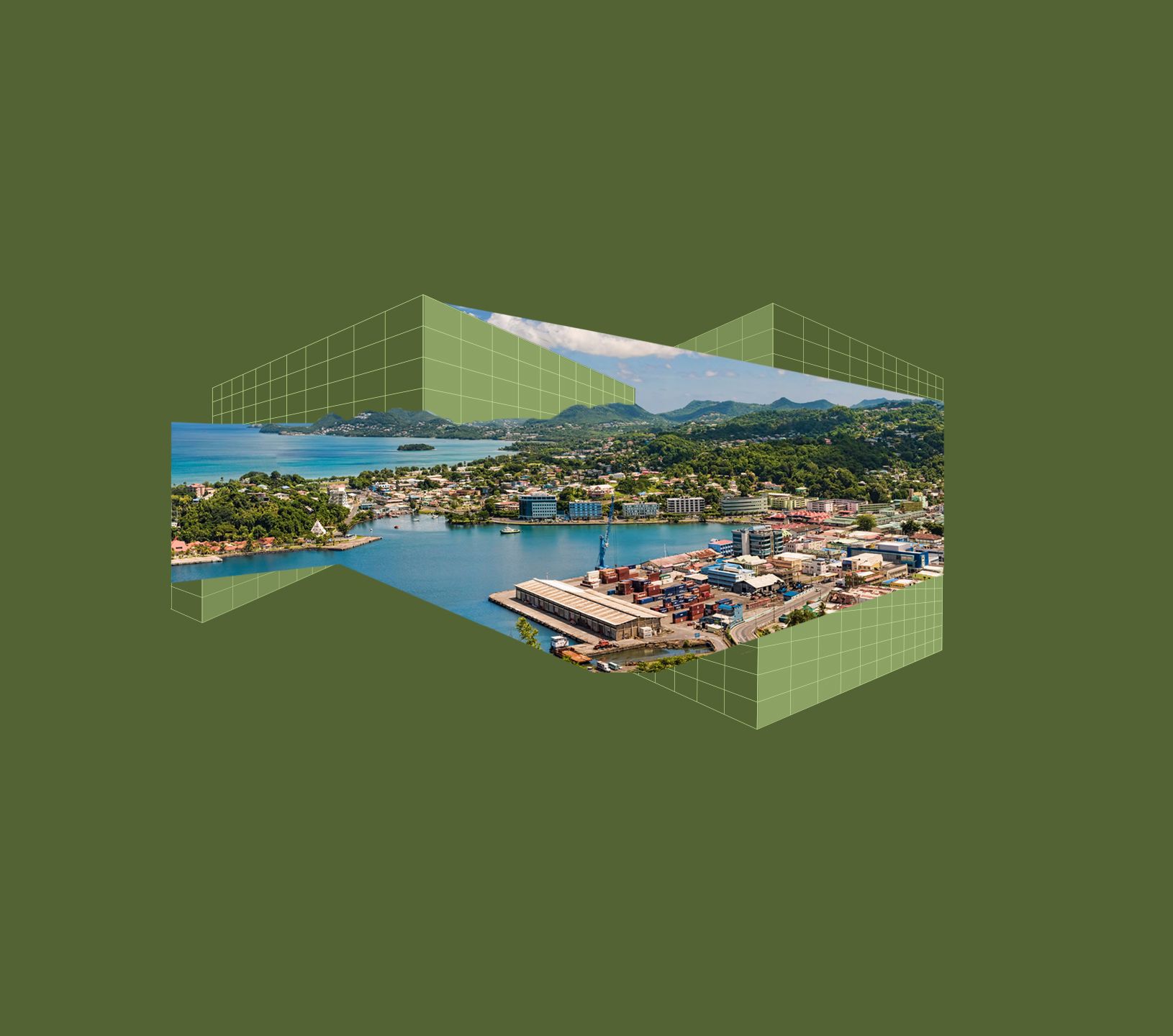

Saint Vincent and the Grenadines

Although Taiwan excels at providing technical assistance and developing human capital, Taipei has also funded infrastructure projects. In 2006, Taiwan granted Saint Vincent and the Grenadines $15 million in aid to build the Argyle International Airport. More recently, Taiwan granted Saint Vincent a $62 million loan for the Kingstown Port Modernization Project, aimed at revitalizing Kingstown’s ports and improving employment levels.

The Taiwan ICDF also developed an intelligent bus management and bus monitoring system aimed at improving the efficiency and safety of the island’s public buses.

The projected impacts include dramatically reducing wait times at bus stops, originally around three hours, by 50 percent.

Guatemala

Taiwan’s commitment to increasing climate resilience is evident in places like Guatemala. Climate change and recent natural disasters have negatively impacted local agriculture, particularly corn, one of Guatemala’s key food staples, intensifying food insecurity in the country.

In March 2023, Taiwan’s ICDF began implementing a project to design high-quality corn hybrid seeds that are more resilient to droughts and pests. The project, a joint venture with the Guatemalan Ministry of Agriculture, Livestock and Food, aims to benefit over a thousand small-scale farmers in rural areas and to increase the yield of corn by 88 percent.

Taiwan has undertaken similar projects to increase resiliency in Guatemala’s banana cultivation, and provided agro-meteorological technologies to track weather changes and identify vulnerabilities in the local ecosystems.

Taiwan’s record in the region features strong anti-corruption safeguards, yet it is not spotless.

In 2014, the former Guatemalan president Alfonso Portillo pleaded guilty to laundering $2.5 million through U.S. banks.

Portillo alleged he received the money from Taiwan as payments to continue Guatemala’s diplomatic recognition of Taiwan, although Taiwan disputes this.

The former president was ultimately sentenced in a New York court to over five years in prison for money laundering conspiracy, based on his efforts to conceal the source and origin of the funds.

Taiwan’s corruption incident stands in stark contrast to China’s record. A William & Mary data set analysis of over 13,427 Chinese development projects shows that 35 percent of BRI projects have involved corruption, labor violations, and environmental threats to local ecosystems.

Despite successful projects throughout LAC, Taiwan cannot compete financially with the PRC on development investment. Level of investment is an important motivator for LAC countries to remain allied to Taiwan.

While countries like the United States demonstrate a willingness to arm Taiwan militarily, they do not effectively lend diplomatic support, which has significant consequences for Taiwan’s future.

Recent agreements between the Taiwan ICDF and the United States Agency for International Development to cooperate on development projects in LAC have the potential to expand Taipei’s development reach and cement its relevance in the Western Hemisphere.

Diplomatic Reversals

The Case of Saint Lucia

While Taiwan cannot outspend China in the Western Hemisphere, its meaningful economic engagement has proven to be transformative for countries that have experienced both China’s and Taiwan’s development and investment.

Saint Lucia switched recognition back to Taiwan after a decade of Chinese development projects. Wooed by China’s promise of monumental investment in the island, Saint Lucia switched its diplomatic recognition from Taiwan to China in 1997. During the 10 years that followed, China built a stadium.

The stadium has been used as a hospital for the past 13 years.

China also opened small businesses but left many of its investment promises unfulfilled.

In 2007, Saint Lucia chose to become a diplomatic ally of Taiwan once again, which challenged the One China principle prescriptive of Chinese-LAC relations. Saint Lucia defended its decision.

“St. Lucia did not win its sovereignty from one power to be now dictated to by another as to who its friends should be. . . . [Beijing's One China principle cannot] be legally or diplomatically thrust on St. Lucia, as though we, too, were a colony of China.”

After the reversal, the ICDF worked with Saint Lucia to design projects with the goal of increasing local farmers’ annual revenue by at least 20 percent and increasing the total agricultural produce sold by Saint Lucian farmers to hotels and supermarkets by 30 percent. Despite Saint Lucia’s success, no other country in LAC has taken a similar step for fear of provoking China.

Still, for LAC countries with pressing infrastructure needs, Chinese aid and foreign direct investment offer immediate relief through the injection of capital into their economies. Many are willing to overlook the lack of transparency and anti-corruption safeguards as a necessary price.

Conclusion

The examples of China’s and Taiwan’s development efforts in LAC represent their divergent approaches.

China’s massive infrastructure projects, lacking feasibility assessments and oversight, contrast with Taiwan’s small-scale, sustainable initiatives.

The projects’ different outcomes, however, are the result of China’s and Taiwan’s distinct objectives in the region: economic value versus diplomatic survival.

As LAC countries on both sides of the divide continue to face the choice between China and Taiwan, achieving a deep understanding of not only the immediate rewards but also the long-term consequences of these relationships is critical.

Made possible by the generous support of the Taipei Economic and Cultural Representative Office in the United States (TECRO).